Convert your unused foreign currency or forex card balance into INR with ease. With Thomas Cook Forex, you can sell currency online at real-time rates securely, digitally, and without stepping out.

Why Choose Thomas Cook for Forex?

Whether you're back from a holiday, business trip, or study program, we make selling currency smooth and stress-free. Here’s why millions trust Thomas Cook Forex:

- Real-Time Exchange Rates with No Hidden Charges

Get the most value for your foreign exchange. Our rates reflect live market pricing with no surprises or hidden fees.

- Full-Service Currency Buy and Sell Platform

From leftover cash to forex card balance, we support every currency buy and sell need under one roof.

- Multiple Branches Across India with Free Doorstep Pickup

Access our wide network or opt for doorstep delivery services to sell foreign exchange from the comfort of your home.

We’re the only forex provider offering video KYC that assists you in completing the entire process digitally and securely.

- 100% RBI-Compliant, Trusted for Over a Century

With over 100 years of experience, Thomas Cook ensures your transactions follow all RBI and FEMA guidelines.

- 24x7 Online Booking with Rate Lock

Sell your forex at your convenience. Pay just 2% to lock the rate and protect against currency market fluctuations.

Which Currencies can you sell on Thomas Cook?

You can sell currency in any of the following 12 major foreign currencies accepted by Thomas Cook:

Whether you're holding cash or card balance, our platform supports seamless currency selling at the best rates.

Sell Forex Online in a Few Easy Steps

With Thomas Cook, converting your foreign currency into INR is quick and effortless. Here's how it works:

- Select the currency and denomination you want to sell

- Enter traveller details and choose delivery/pickup preference

- Pay 2% to block the exchange rate

- Visit the nearest branch or complete the order online

- Get paid as per the locked or current rate

- The blocking fee is refunded within 4–7 working days

No paperwork. No queues. No unnecessary delays.

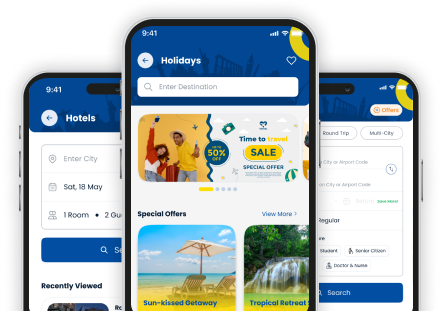

Find the Right Thomas Cook Forex Card for Your Needs

As you plan your next international trip, opt for Thomas Cook forex cards. Whether you are a frequent or an occasional one, there is a card for all:

| Card Name |

Best For |

Key Features |

| One Currency Card |

Single-country trips |

Load in USD, spend globally with 0% cross-currency fees, accepted at 35M+ merchants, ₹7.5L insurance cover. |

| Borderless Prepaid Multi-Currency Card |

Multi-destination travellers |

Carry up to 11 currencies, 25% off Klook activities, lounge access at international airports. |

| Study Buddy Card |

Students studying abroad |

Free ISIC card, instant reloads from India, insurance cover up to $10,000. |

| EnterpriseFX Card |

Business travelers |

Eco-friendly recycled card, earn TC Edge reward points, and complimentary lounge access. |

Use these cards to manage your travel expenses and easily sell foreign exchange or buy forex left over when you're back.