Need the best currency exchange in Mumbai Click to find out why it's the top choice!

Mumbai is a city that never sleeps and where dreams are made and materialised. From students making plans for studying abroad to traders rushing to the BSE in Dalal Street to make the next big deal, life in Mumbai is shrouded with relentless hustle and efficient investment of one's time. Being an essential centre of personal travel and global commerce in India, Mumbai's demand for foreign currency exchange is always on the higher end of the curve. Hence, as a resident of this lively city, it becomes vital to know everything there is to currency exchange in Mumbai.

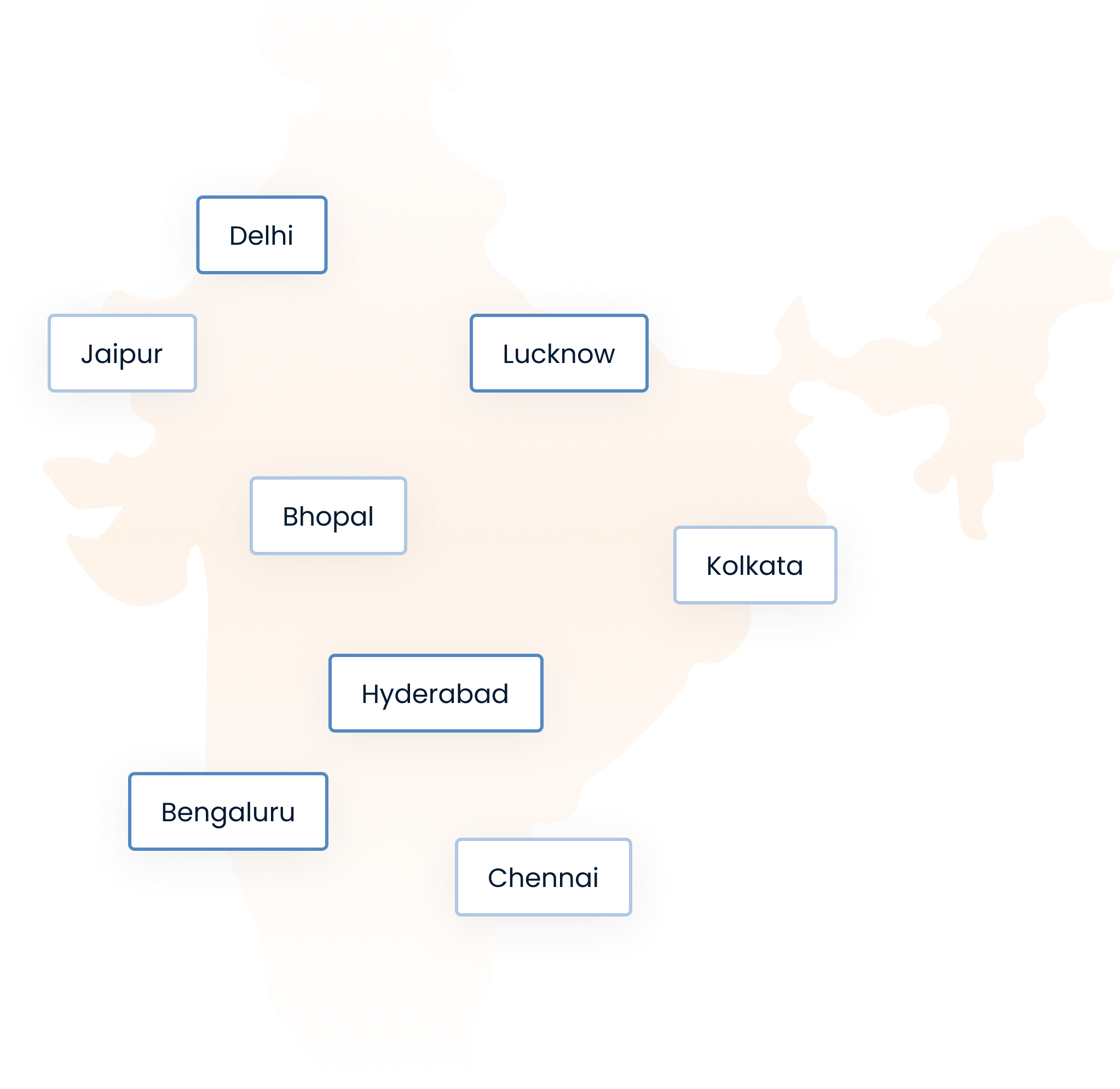

Thomas Cook offers hassle-free online currency exchange in Mumbai for various kinds of individuals. You can also locate our offline store for your forex needs by searching "Thomas Cook currency exchange near me". Whether you need to remit money abroad for higher education, carry forex for expenditures on a foreign trip or handle a business deal overseas, Thomas Cook is your one-stop shop for all your forex needs in Mumbai.

Live Forex Rates in Mumbai You Can Trust

As you may already know, foreign currency exchange rates are not static. They are influenced by various factors around the globe, which is why they keep fluctuating every second. Thomas Cook understands how important it is for our customers to get the best deal possible when opting for money exchange in Mumbai. Hence, we offer live, up-to-date forex rates on our website as part of our transparent and reliable service. By keeping track of the forex rates in real-time, you can find the best deal for your needs. Additionally, you can use the rate-locking mechanism to secure that exact rate at the time of your transaction, protecting yourself from market fluctuations. If you need help with this, search for "Thomas Cook currency exchange in Mumbai near me" and get help from our trained officials.

Unlike the hidden fees and unfavourable rates offered by airport money changers and unauthorised forex dealers, our reliable service, competitive rates, and transparent pricing make us the safer and smarter choice for currency exchange in Mumbai. A simple search for "Mumbai airport currency exchange rate" and cross-checking it with our website will make it abundantly clear.

Things to Keep in Mind When Exchanging Money in Mumbai

When exchanging money in Mumbai, here's what to do and avoid:

Do's

- Research: Do some advanced research about forex rates online, as well as "forex exchange near me", before booking your order. It will help you understand the fluctuations, so you can identify the best deal for your needs.

- Lock-in rate: If you find a favourable rate for your foreign currency exchange in Mumbai, make sure to lock in the rate to save yourself against market shifts.

Don'ts

- Wait till the last minute: Make sure to exchange foreign currency in advance. If you leave it to the last minute, you may have to settle for whatever unfavourable rates are available.

- Exchange via unverified dealers: Avoid exchanging money through unverified forex dealers that you find via searching "forex near me".

Why Mumbai Locals Prefer Thomas Cook for Forex?

Here's why Mumbaikers rely on Thomas Cook for their forex:

RBI-authorised dealer:

The foreign currency exchange services by Thomas Cook strictly adhere to all the necessary RBI rules and regulations. Hence, you can exchange currency via Thomas Cook with confidence.

Exceptional service:

All our forex services are handled securely and promptly. Additionally, you can opt for foreign exchange in Mumbai with Thomas Cook via both offline and online methods. You can locate an offline store by searching "Thomas Cook forex exchange near me".

No hidden fees:

We not only offer up-to-date rates and live tracking, but also transparent pricing with no hidden fees. With us, you are guaranteed to get the best value for your money.

Customer support:

We hold user experience to a very high standard. Alongside our user-friendly forex booking process, you can get personalised assistance for your forex order by contacting our customer service team.

From Powai to Juhu, We Serve Every Forex Need

We make getting forex a hassle-free experience for customers across various localities of Mumbai. Here's how we help;

- In Powai, we assist students with their foreign currency exchange needs as they plan their next step in education abroad.

- In Goregaon, we simplify foreign currency exchange for local businesses and companies. Whether you need currency for an upcoming corporate trip or have a foreign client transaction to manage, we have the answers.

- In Juhu, we provide forex solutions to families planning their international vacation or looking to remit funds abroad.

To find our offline branch near your locality, search for "Thomas Cook near me" on the web.

Who We Help — From First-Time Flyers to Frequent Travellers

We help each traveller with their foreign currency exchange needs in Mumbai, such as:

Travel:

Foreign vacations are all about relaxing and enjoying your time. Any hassle related to forex can ruin the mood. Hence, we offer streamlined foreign currency exchange in Mumbai for leisure travellers.

Education:

Pursuing higher studies abroad can be quite expensive, which is why it is essential to get forex at the best rate from a reliable source. Students and their families in Mumbai book forex at the best value with the assurance of Thomas Cook.

Medical:

If you are heading abroad for a medical treatment or consultation, you will need forex to cover the expenses. With Thomas Cook, you can enjoy hassle-free forex booking in Mumbai with full transparency.

Business:

Professionals scheduled to catch an international flight for their business travel need foreign exchange quickly and at the right rate. By opting for our foreign currency exchange, we ensure they get just that.

How to Book Your Foreign Exchange in Mumbai

Here's how you can book your foreign currency exchange in Mumbai in four easy steps with Thomas Cook:

Step 1: Choose currency

On the forex page, select the preferred product type, currency, and amount. Then, enter your contact details to get a quote.

Step 2: Enter details

Share the traveller and trip details as required, alongside submission of the necessary KYC documents. Once done, pick the preferred mode of delivery, i.e., doorstep delivery or nearby branch pickup.

Step 3: Pay online

Pay the quoted price online via the available payment modes, such as UPI, netbanking, credit/debit cards, etc.

Step 4: Get delivery

Once payment is made, the booking is confirmed. Wait for your forex delivery or pick it up from a nearby branch, whichever mode you have picked.

A Better Way to Exchange Money in Mumbai Starts Here

Whether it's the families in Juhu planning a foreign trip or students of Powai planning their higher education, the demand for foreign exchange in the bustling city of Mumbai remains at its all-time high. Thomas Cook makes the process of booking forex in Mumbai a streamlined experience, with its online and offline methods. With us, you get access to reliable forex transactions at competitive rates with no hidden costs. Additionally, you can have your order delivered to your doorstep or opt for a branch pickup, and you can dial our customer support for any assistance related to your forex order.

FAQs About Foreign Currency Exchange in Mumbai

Is there currency exchange at Mumbai airport?

Yes, currency exchange counters are available at Chhatrapati Shivaji Maharaj International Airport. However, airport rates are usually higher than city-based providers and makes it costlier for travellers.

Where can I convert INR to USD in Mumbai?

You can convert INR to USD at authorised forex providers, banks, and Thomas Cook branches across Mumbai. Choosing a trusted provider ensures secure service and competitive rates.

In which bank can we change currency in Mumbai?

Most leading banks in Mumbai offer currency exchange services, but rates differ from bank to bank. Travellers often find more convenience and better rates with authorised forex providers.

What documents are needed for currency exchange in Mumbai?

For currency exchange, you need valid KYC documents such as a passport, visa, PAN card, and travel tickets. These documents ensure compliance with RBI guidelines and smooth processing.

People Also Searched For

US Dollar Rate in Mumbai | Euro Rate in Mumbai | Thai Baht Rate in Mumbai | Chinese Yuan Rate in Mumbai | UAE Dirham Rate in Mumbai | Malaysian Ringgit Rate in Mumbai | Japanese Yen Rate in Mumbai | Saudi Riyal Rate in Mumbai | Singapore Dollar Rate in Mumbai | Australian Dollar Rate in Mumbai | Hong Kong Dollar Rate in Mumbai | British Pound Rate in Mumbai | Bahraini Dinar Rate in Mumbai | Swedish Krona Rate in Mumbai