Need the best currency exchange in Delhi Click to find out why it's the top choice!

Delhi is a city with a lot of heart and character in India. From students crunching current affairs in Rajendra Nagar to tourists waiting for their flight at Indira Gandhi International Airport for their foreign trip, life in Delhi is always fast-paced. The demand for foreign currency exchange in a city like this is always at its peak. Everything from businesses and tourism to foreign remittance and education trips, knowing where to go for currency exchange in Delhi is essential.

Residents of Delhi can easily meet their foreign exchange needs via Thomas Cook’s online and offline forex service. Our forex service covers every nook and cranny of the city, ensuring fast, economic and reliable solutions. Just search "Thomas Cook forex near me" and you will locate our offline store. Whether it's remitting funds to your loved ones abroad or loading your prepaid forex card with travel funds, Thomas Cook makes currency exchange in Delhi simple.

Live Forex Rates in Delhi You Can Trust

We understand how important transparency is, which is why we offer real-time, up-to-date rates, making your experience of currency exchange in Delhi as convenient as possible. As you know, exchange rates are not fixed and they are constantly fluctuating by the hour, minute and even second. This is why keeping track of the latest rates is essential if you want to secure the best deal. With Thomas Cook, you can track the rate of all the foreign currencies we offer, such as THB, USD, EUR, etc., at any time. Additionally, you can use our rate-locking mechanism to lock in the rate you prefer. If you want guidance in this, search "Thomas Cook forex exchange near me" and seek assistance from our experts.

This ensures that you get the best value when changing currency via Thomas Cook every single time. Unlike exchanging currency at airport counters or unauthorised dealers that you get by searching "currency exchange near me", we offer forex at competitive rates with transparent and real-time rate tracking.

Things to Keep in Mind When Exchanging Money in Delhi

Here are some key things to do and avoid while opting for currency exchange in Delhi:

Do's

- Research regularly: If you have time, research to identify the best deal. Look online and also locally by searching "forex exchange near me".

- Lock-in rate: After research and tracking, if you find a rate that is the most favourable, make sure to use the lock-in feature to ensure you get that deal and avoid overpaying.

Don'ts

- Exchange at the airport: Avoid currency exchange at airports as they offer unfavourable rates. Just a quick search about "Delhi airport currency exchange rate today" is enough to prove this point.

- Exchange via unauthorised dealers: Avoid currency exchange via unauthorised dealers, as they often engage in fraud and scams.

Why Delhi Locals Prefer Thomas Cook for Forex?

The residents of Delhi have put their trust in Thomas Cook for their forex needs because of the following:

High-quality service:

When changing currency in Delhi via Thomas Cook, you get a premium quality service every time. Starting from placing your order to receiving it at your doorstep, we ensure a smooth experience through and through.

RBI-authorised dealer:

Thomas Cook is synonymous with reliability. Our currency exchange service adheres to the strict RBI regulations and foreign remittance norms, unlike the unverified money exchangers near you.

Transparent pricing:

We offer transparent pricing with up-to-date rates and real-time tracking. We don’t charge any hidden fees, and you get to see exactly what you are paying for.

Customer assistance:

At Thomas Cook, we hold customer satisfaction to the highest level. This is why our currency exchange service is user-friendly, and we have customer support executives to guide you through the process.

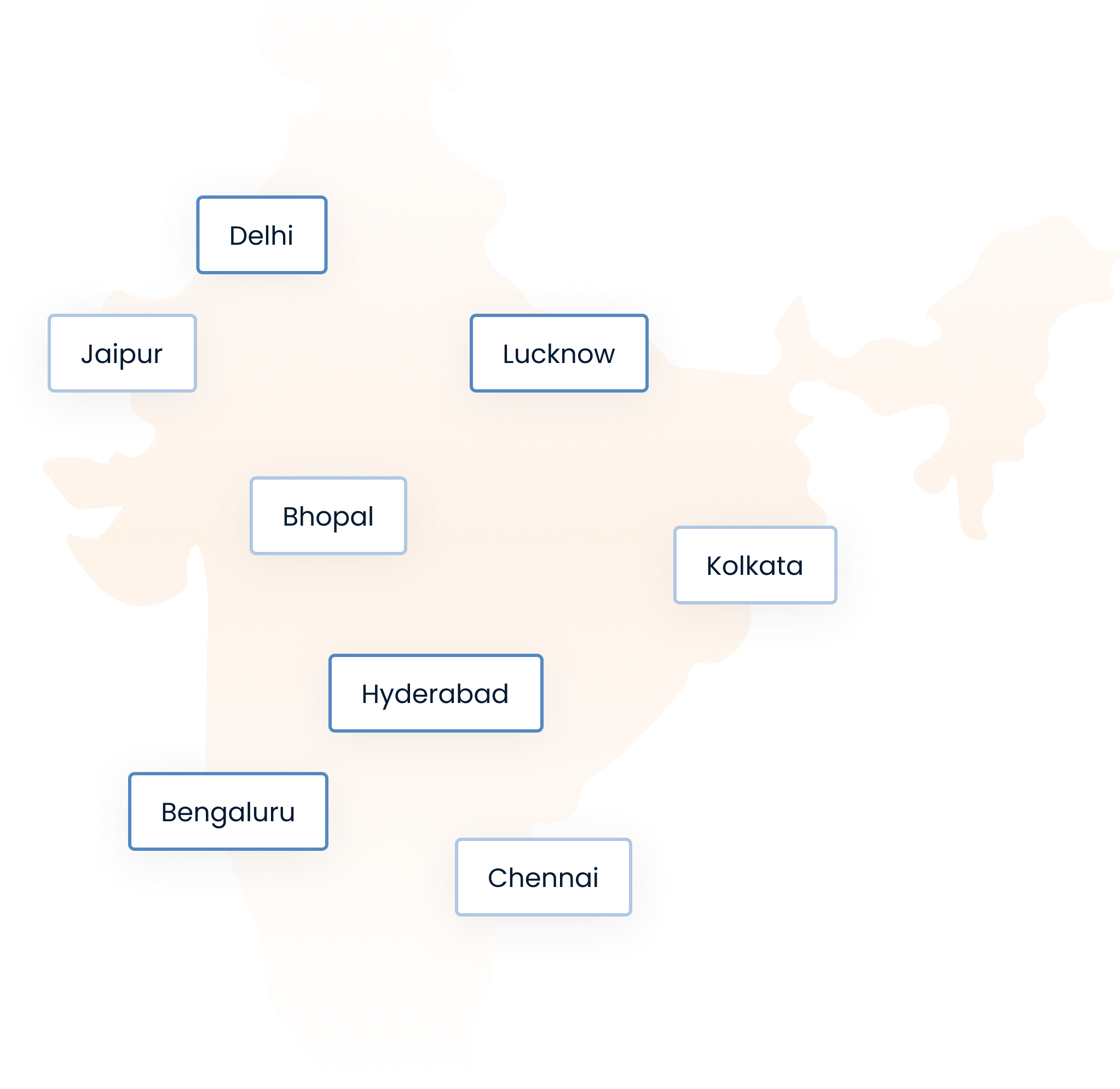

From Mukherjee Nagar to Connaught Place, We Serve Every Forex Need

No matter which corner of Delhi you live in. If you have a forex need, you will find your solution at Thomas Cook. We understand the core nature of Delhi’s forex needs, which lets us cater to its rising demands. For example;

- In Mukherjee Nagar, we assist students with foreign currency exchange so they can arrange for their higher studies abroad with ease.

- In Greater Kailash, we make it easier for families to meet their foreign remittance and forex for tourism requirements.

- In Connaught Place, we support businesses of all sizes, handling all their foreign currency exchange needs, regardless of the transaction amount.

Who We Help — From First-Time Flyers to Frequent Travellers

We help real people with their day-to-day foreign currency exchange requirements in Delhi in an efficient manner. We help with;

Travel:

We offer our forex service to individuals heading abroad for a leisure trip. We assist them with their money exchange in Delhi alongside transparent prices and doorstep delivery, saving them from unfavourable airport exchange rates.

Education:

Studying abroad can be very expensive, and the last thing you need is a problem with foreign exchange. This is why Thomas Cook makes currency exchange in Delhi as convenient and reliable as possible for families of students.

Medical travel:

When it comes to travelling abroad for medical consultation or treatment, we prioritise prompt and secure currency exchange in Delhi. This ensures hassle-free forex solutions so you can focus on your medical travel.

Business:

When it comes to professionals heading abroad for corporate trips, we cater to their forex needs with our streamlined and reliable services of foreign exchange in Delhi.

How to Book Your Foreign Exchange in Delhi?

Step-by-step process to book a foreign currency exchange in Delhi with Thomas Cook:

Step 1: Choose currency

Select the product type, i.e., cash, card or combo, pick the required currency and enter the amount. Then, type in your contact details and click on "Get Your Quote".

Step 2: Enter details

Provide the required details, like traveller details, date of travel, etc., submit KYC documents and choose the delivery type.

Step 3: Pay online

Go to the secured online payment gateway and pay via credit/debit card, UPI, netbanking, or any of the available methods.

Step 4: Get delivery

After payment, the booking will be confirmed. It will soon be delivered to your address. If you’ve selected branch pickup, you will have to collect it from a nearby Thomas Cook offline office. To find an offline office, search "Thomas Cook currency exchange in Delhi near me" on the web.

A Better Way to Exchange Money in Delhi Starts Here

Thomas Cook makes foreign currency exchange in Delhi a hassle-free experience. We offer forex at competitive rates with real-time rate alerts. Additionally, you can use our rate lock-in feature to get the deal you find most suitable for your needs. No need to rely on unverified money exchangers or airport exchangers with unfavourable rates. Enjoy the convenience of online forex booking and doorstep delivery in Delhi with Thomas Cook. Alternatively, you can opt for this service via our offline branch in Delhi. You can locate a store by searching "Thomas Cook near me" on the web. Also, our human support team is always available to guide you through every transaction.

FAQs About Currency Exchange in Delhi

What are the fees for currency exchange in Delhi?

Most forex providers in Delhi charge a markup of about 1%–5% on the exchange rate plus a fixed service fee (₹100–150) when you buy or sell foreign currency. Thomas Cook typically offers competitive, transparent rates and may waive service fees in certain promotions (while still applying a small markup).

Where is the best place to exchange money in Delhi?

The best places are RBI-authorised, trusted forex outlets in central/local hubs like Connaught Place or Karol Bagh, or a branch of Thomas Cook. Using Thomas Cook ensures reliability, transparent charges, live rates, and better customer experience than airport counters.

What is the bank exchange rate in Delhi?

Bank exchange rates in Delhi vary by bank and currency. For instance, today USD buy rate via authorised exchangers is around ₹87–₹89 per USD, and sell rates slightly different. Thomas Cook publishes its live buy & sell rates online, which are usually close to these rates plus the provider’s markup.

Which bank is best for currency exchange in Delhi?

There isn’t a single "best" bank for foreign exchange, as rates differ across banks and change daily. For more competitive and transparent rates, many travellers prefer authorised forex providers like Thomas Cook, which also offers the convenience of online booking and live rate checks.

US Dollar Rate in Delhi | Euro Rate in Delhi | Thai Baht Rate in Delhi | Chinese Yuan Rate in Delhi | UAE Dirham Rate in Delhi | Malaysian Ringgit Rate in Delhi | Japanese Yen Rate in Delhi | Saudi Riyal Rate in Delhi | Singapore Dollar Rate in Delhi | Australian Dollar Rate in Delhi | Hong Kong Dollar Rate in Delhi | British Pound Rate in Delhi | Bahraini Dinar Rate in Delhi