Need the best currency exchange in Pune Click to find out why it's the top choice!

Pune isn't just Maharashtra's cultural capital; it's a city blending historic sites with modernisation. Students flying abroad for studies, IT professionals travelling for global projects, and tourists exploring new horizons, almost everyone here has one thing in common: the need for reliable currency exchange in Pune. Now, whether you're heading to Germany for your master's, Singapore for a conference, or Switzerland for that long-awaited vacation, forex becomes your travel lifeline.

But here's the thing: hunting for a money exchange in Pune that's both transparent and trustworthy can be tricky. That's where Thomas Cook steps in. We bring convenience, safety, and top-notch exchange rates right to your fingertips. With real-time updates, RBI-authorised operations, and doorstep delivery, forex exchange in Pune has never been this easy or this efficient.

Live Forex Rates in Pune You Can Trust

Exchange rates change faster than the weather during Pune's monsoon, so it pays off to be alert. Thomas Cook ensures you always get the best deal through live forex rates in Pune, which are updated in real time. You can even lock in your preferred rate before stepping out, saving yourself from last-minute surprises.

Compared to airport counters that often charge a hefty premium, or unauthorised dealers who may not follow regulations, Thomas Cook provides a balance of transparency and security. Every transaction is tracked, fair, and RBI-approved, which makes sure your currency exchange near me search ends with confidence and peace of mind.

Things to Keep in Mind When Exchanging Money in Pune

Do's:

- Compare Before You Commit: Always check live forex rates online before Googling "forex near me" or heading to any forex exchange in Pune. A few minutes of research can save you a lot.

- Ask for Receipts: Make sure every exchange is properly documented. It's not just about safety; it helps if you ever need proof for travel or audits.

- Plan Early: Don't wait until your flight is tomorrow. Booking early gives you better rates and less stress.

Don'ts:

- Avoid Street Dealers: That "too good to be true" deal from an unverified money exchange in Pune near me could cost you big later.

- Don't Exchange at Airport or Other Convenience Centres: Unless you enjoy paying extra for convenience, counters at railway stations or airports are rarely your best option.

Why Punekar Prefer Thomas Cook for Forex?

RBI-Authorised Assurance: Every Thomas Cook branch follows strict RBI guidelines. This is not something that every "currency exchange in Pune near me" search result can promise.

- Transparent Pricing: Thomas Cook offers honest forex exchange in Pune at rates you can check anytime. No hidden costs, no sneaky mark-ups.

- User-First Experience: From online rate locking to doorstep delivery, every feature offered by us is designed with your convenience in mind.

- Trusted Legacy: With decades of expertise, Thomas Cook remains the go-to name for currency exchange in Pune, offering reliability that outshines pop-up kiosks and random dealers.

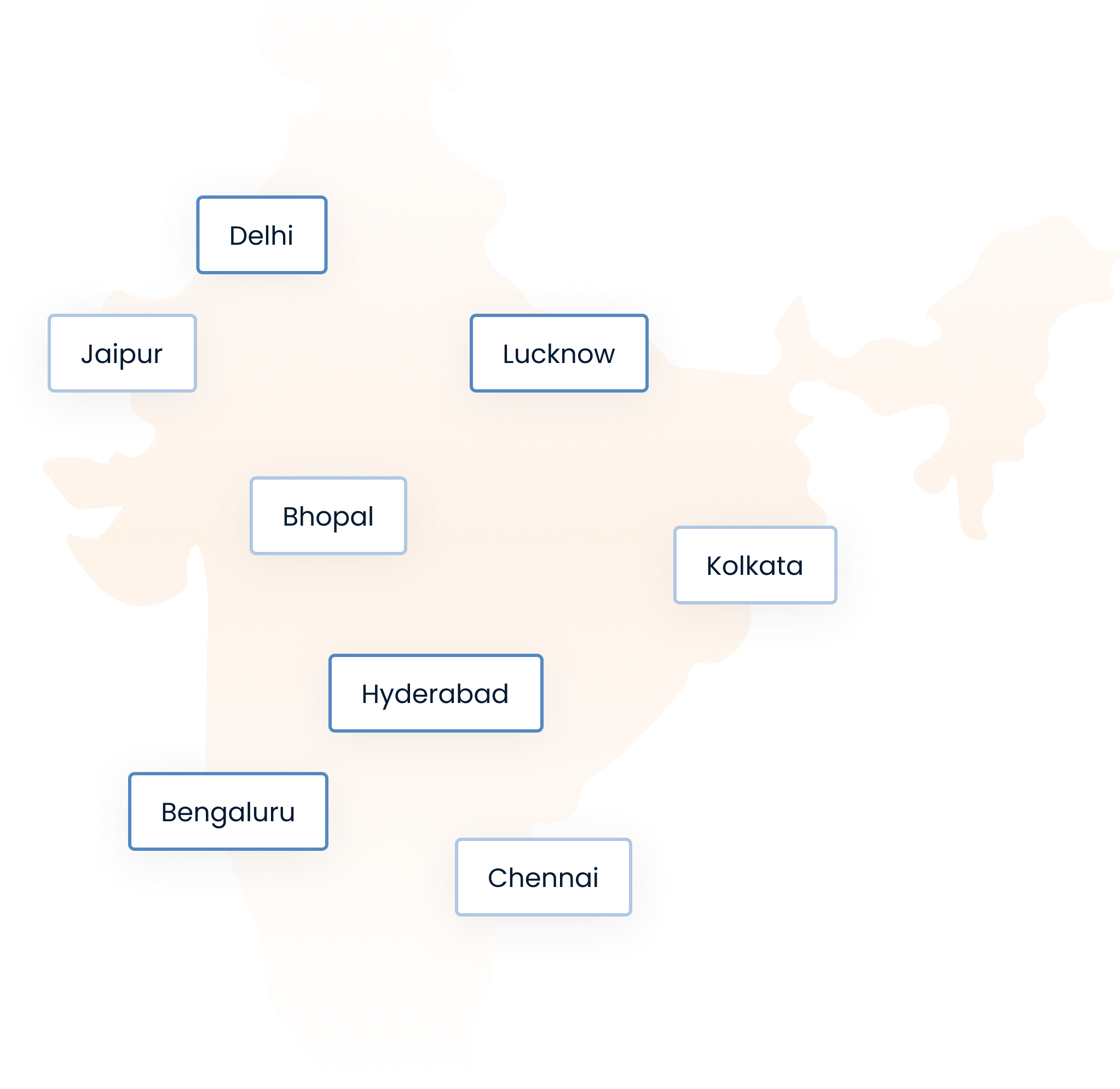

From Deccan to Hinjawadi, We Serve Every Forex Need

Students in Deccan & Viman Nagar: Whether you're heading abroad for higher studies or a short exchange program, we help with student forex cards and currency exchange in Pune.

- NRIs in Kalyani Nagar & Aundh: Regular transfers and travel back home? Our services ensure your foreign exchange in Pune is smooth and cost-effective.

- Tourists in Koregaon Park: Planning that Euro trip or a Bali break? We make sure your vacation funds are sorted before your suitcase is.

- Business Hubs in Hinjawadi & Magarpatta: Frequent flyers and corporate travellers rely on our fast and compliant forex process.

- Families in Camp & Baner: Whether it's medical travel or visiting relatives abroad, our money exchange in Pune services keep your journey worry-free.

Who We Help — From First-Time Flyers to Frequent Travellers?

Whether it's your first trip abroad or your fifth this quarter, we understand that foreign exchange in Pune isn't just about money. It is about peace of mind. Here's how we help:

- First-Time Travellers: You've got enough on your plate already. You need to take care of your visas, packing, and checklists. We simplify your forex so you can focus on the excitement, not the exchange rate.

- Students: For those heading overseas to study, our education-friendly forex services make tuition payments and travel allowances smooth and stress-free.

- Medical Travellers: When travel is urgent and time matters most, our quick and verified forex exchange near me ensures you have what you need without delays.

- Business Travellers: From last-minute flights to overseas meetings, we offer fast, compliant, and reliable forex so your plans stay on schedule.

How to Book Your Foreign Exchange in Pune?

Booking forex online with Thomas Cook is as easy as grabbing a filter coffee in Koregaon Park. Here's how:

- Choose Your Currency: Select the foreign currency you need and the amount.

- Enter Your Details: Provide your basic info and upload necessary KYC documents.

- Pay securely: Complete your payment online using trusted payment options.

- Collect or Get It Delivered: Pick up your order from a nearby branch or enjoy doorstep delivery. You can choose whichever suits you best.

A Better Way to Exchange Money in Pune Starts Here

Exchanging foreign currency shouldn't feel like a maze of rates, hidden charges, and long queues. With Thomas Cook, you get the confidence of a trusted name that has simplified forex for generations of travellers, and now, it's even easier. Whether you're a student heading abroad, a business traveller managing tight schedules, or a family planning your next getaway, our online platform lets you compare rates, choose your currency, and complete your booking in minutes.

Prefer a personal touch? Walk into any of our Pune branches and get expert assistance from professionals who genuinely care about getting you the best value. This removed any guesswork or stress from the entire process. With Thomas Cook, you're not just exchanging money; you're choosing peace of mind, convenience, and support whenever you need it. Check for "Thomas Cook near me" or visit our website for more details. Your better forex experience begins right here, in Pune.

FAQs About Foreign Currency Exchange in Pune

How to exchange currency in Pune?

Visit an RBI-authorised forex provider or bank, compare the rates, and carry valid documents like passport, visa, and PAN card. Complete the exchange, collect your currency, and keep the receipt for record.

Does Pune airport have currency exchange?

Yes, Pune airport has currency exchange counters. However, the rates are generally higher than city outlets, so travellers end up paying more during the exchange.

What is the cheapest way to exchange currency in Pune?

The most cost-effective way is to exchange through authorised forex providers in the city rather than airport counters. Checking live rates and planning ahead helps you save on hidden charges.

Where to exchange currency in Pune?

You can exchange currency at authorised banks, money changers, and forex services . Thomas Cook branches in Pune are a trusted choice, offering competitive live rates, online booking, and secure service. You can also exchange currency via their app.

People Also Searched For

US Dollar Rate in Pune | Euro Rate in Pune | Thai Baht Rate in Pune | Chinese Yuan Rate in Pune | UAE Dirham Rate in Pune | Malaysian Ringgit Rate in Pune | Japanese Yen Rate in Pune | Saudi Riyal Rate in Pune | Singapore Dollar Rate in Pune | Australian Dollar Rate in Pune | Hong Kong Dollar Rate in Pune | British Pound Rate in Pune | Bahraini Dinar Rate in Pune